Accounting Checklist

Using the checklist

You don’t need to be a CPA to be a PTO/Booster Club Treasurer. With RunPTO, you can easily create a income statement or balance sheet or enter transactions for your PTO/Booster Club. This checklist enables anyone to perform accounting activities in your PTO/Booster Club, and as you go through you’ll see the different steps explained where necessary. This way, you know what you’re doing and why you’re doing it.

Know the Key Terms

- Financial Year is the period for which the annual accounts of a organization are maintained and audited. A typical financial year for a Parent Teacher Organization runs between July 1st to Jun 30th of the subsequent year.

- Chart of Accounts is a list of the accounts that a Parent Teacher Organization/Booster Club uses to keep track of its income, expenses, assets and liabilities.

- Budget is an estimate of the financial goal projected for the financial year. It is a plan or estimate of how a organization will spend and receive money during the financial year.

- Debit (Deposits) is a term used to describe the side of an account where monies are deposited.

- Credit (Withdrawals) is a term used to describe the side of an account where monies are withdrawn.

- Transfers are defined as an transfer of funds from one side of an accounting entity to another.

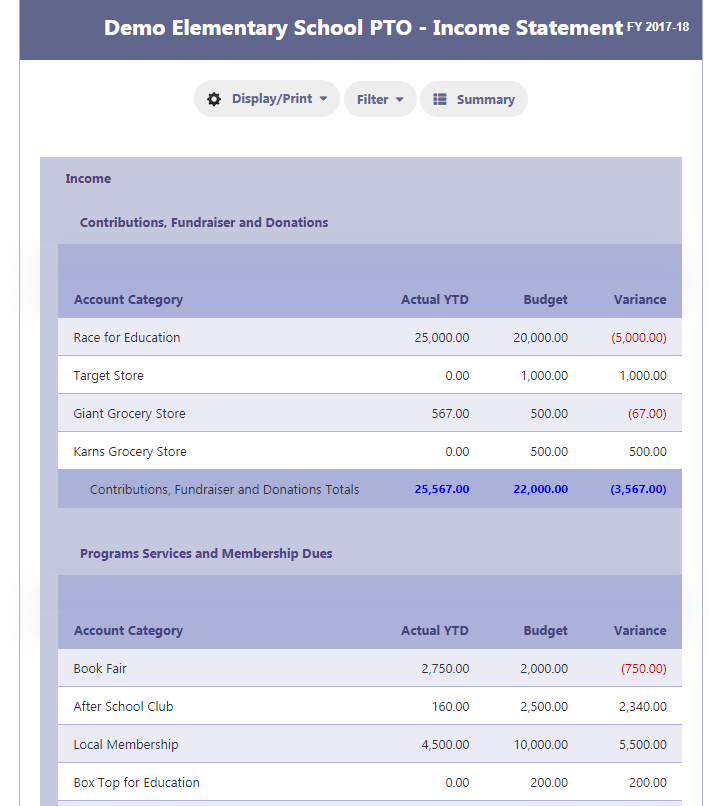

- Income Statement is a financial statement that reports the revenues, expenses and net income/loss for a organization during the financial year.

- Bank Reconciliation is the process of comparing the balances of a bank statement with the balance as per the books of accounts

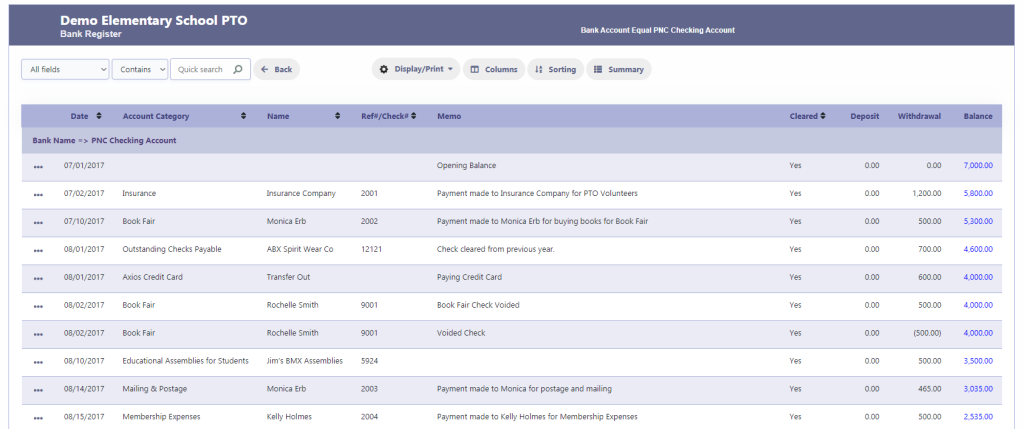

- Bank Register is a statement in which the deposits, withdrawals, and balances of each bank account are recorded.

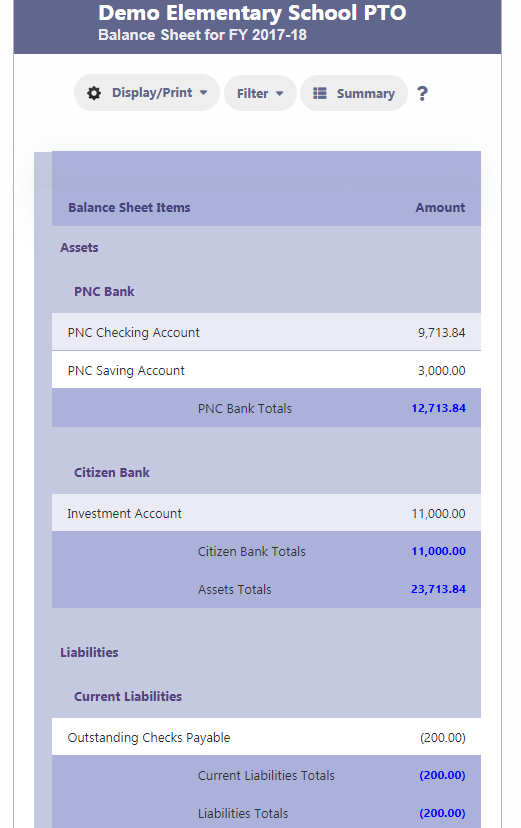

- Balance Sheet is a statement of the assets, liabilities and net worth of your organization

- Financial Dashboard is a single page of charts and numbers that you can see at a glance and use to make decisions. It is a dynamic and ever changing view of your organization finances. This would be your Treasurer’s Report.

Check out the Finance Video

Complete your Chart of Accounts

- Your Chart of Accounts comes with default Account Groups. You can create more groups or modify the names of the default groups as per your requirements.

- Create the needed income and expense accounts under those Account Groups.

- Enter the name of your bank checking account.

- Create Payment Processor accounts like Paypal, Stripe, Square etc in the Bank Group

- Liability accounts like Outstanding Checks Payable, Sales Tax Payable etc as needed

- Assign accounts to Committees if Committee wise reports needed.

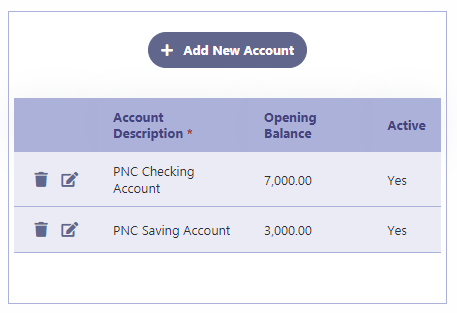

Bank Opening Balances

- Enter the opening balances for your Bank Checking/Savings and other Bank accounts.

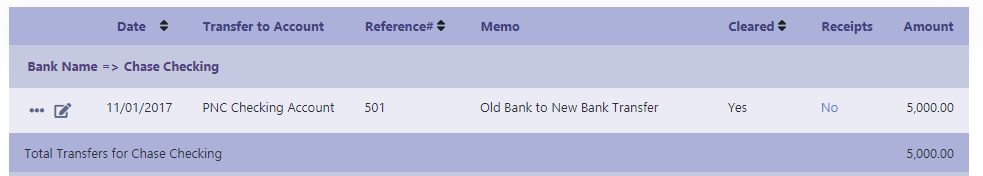

Transfer from Old Bank to New Bank

If you are going to have a new bank account for the current school year and the balance is transferred from an old bank account

- Create an account for the old bank account

- Enter the balance for that account

- Do a Transfer transaction from the old bank account to the new bank account.

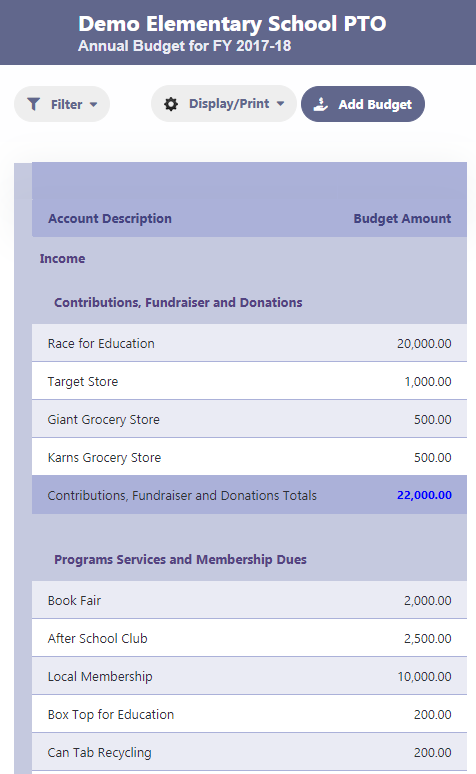

Prepare the Budget for the Year

- Click on Add Budget and start entering the allocations for each account

- Export the budget to a PDF file and share it with your Board members.

Deposits, Withdrawals and Transfers

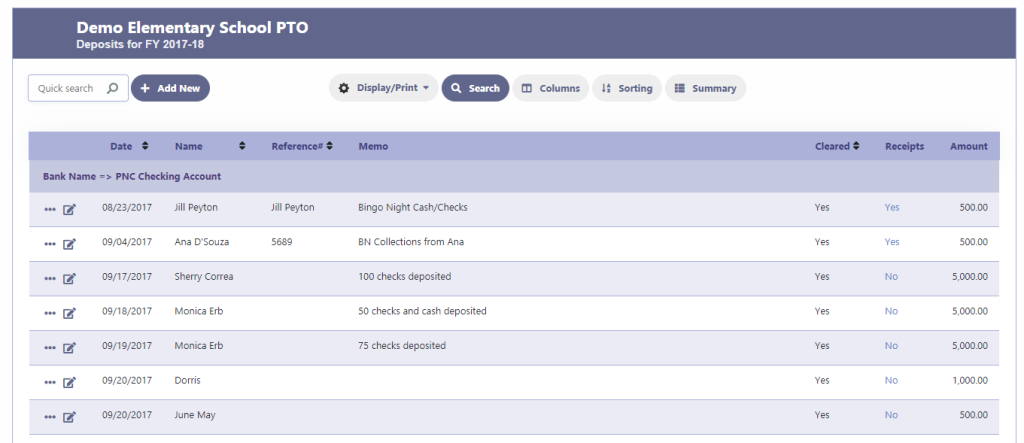

- Post your financial transactions for Deposits, Withdrawals and Transfers

Outstanding Checks Payable

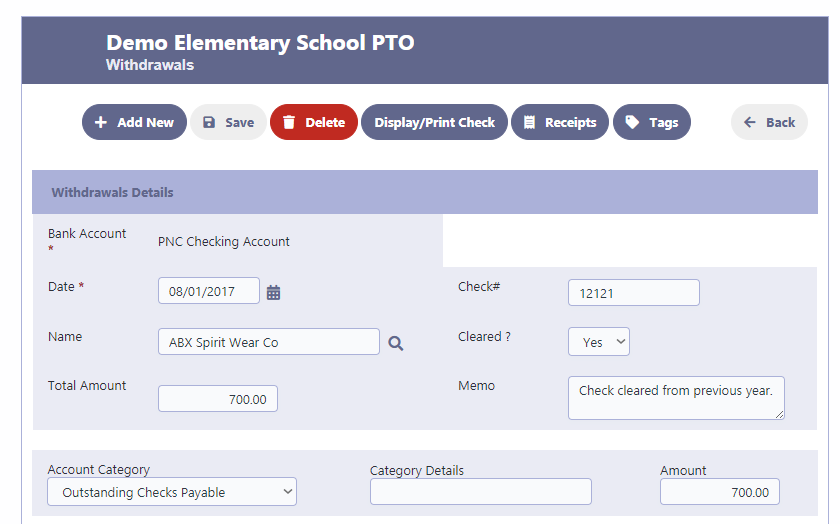

Are there checks not cleared from previous year?

- Create a Outstanding Checks Payable Account in Liabilities

- Enter the balance amount of checks not cleared in the opening balance column.

- Whenever a check is cleared, post the transaction in Withdrawals i.e credit the bank, debit the Outstanding Checks Payable account.

Handling Square, Paypal, Stripe transactions

Actually your transaction is happening in the Square account (It could be Paypal). Let’s say your Bank Account is PNC Bank.

- You would open another Account Bank Group called Payment Processors

- You will have accounts underneath it called Square, Paypal etc.

- Record the transactions accordingly. Let’s say the merchandise being sold is T-Shirts.

- Go to Deposits and select your Bank as Square for a debit entry and credit your T-Shirt account for $15

- Go to Withdrawals and select Square as your Bank for credit and then debit Square Processing Fees for $3

- Whatever date the money is transferred from Square to PNC Bank, create a entry in Transfers showing Transfer from Square to PNC Bank for $12.

The above will reflect correctly the way the transactions are actually processed.

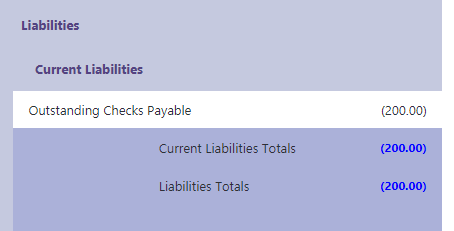

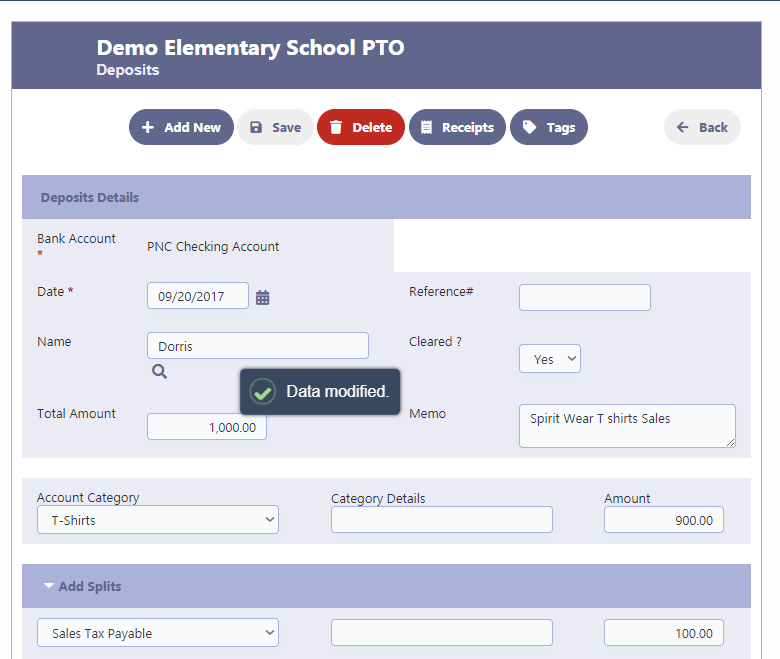

Sales Tax Payable

Even though it is a Cash based system, you can open Assets and Liability accounts for Sales Tax Payable or Funds going to National or State PTA and do transactions with these Liability accounts. With this flexibility, you are not forced with workarounds like pseudo bank accounts or showing your funds in the Income Statement which do not belong there with forced descriptions.

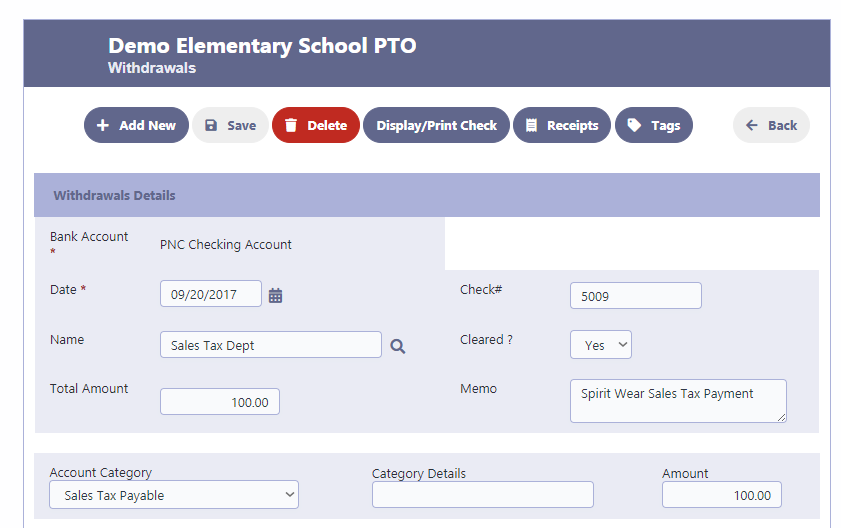

- Create Sales Tax Payable Liability accounts

- Assign the portion of the Sales to the Sales Tax Payable account when the Deposit transaction is created

- When a payment is made to the Sales Tax Department create a Withdrawals transaction with the Sales Tax Payable account.

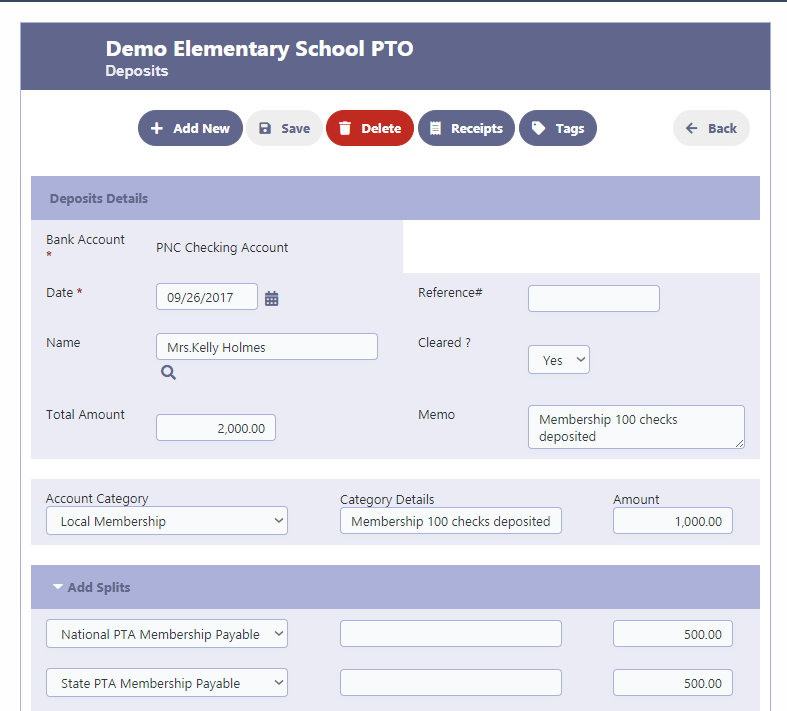

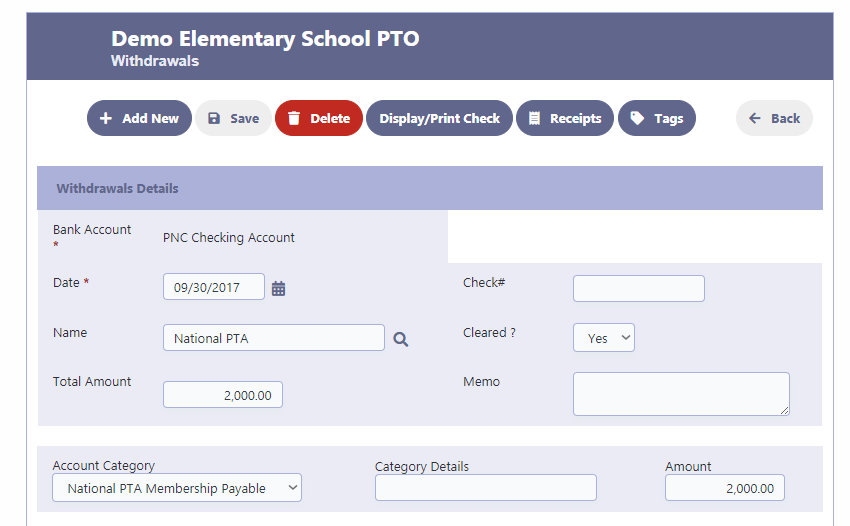

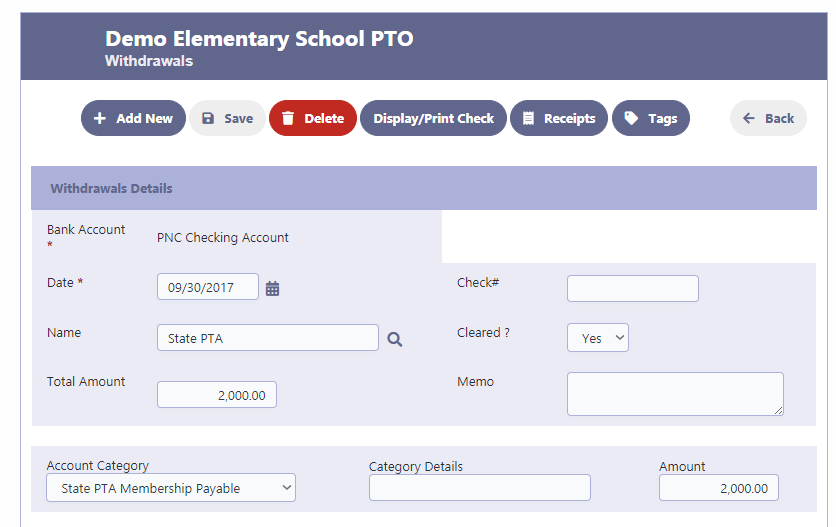

Splitting Membership Fees with National/State PTA or any other Organization

- Create National PTA Membership Payable & State PTA Membership Payable Liability accounts

- Assign the portion of the fees to those accounts when the Deposit transaction is created

- When a payment is made to National PTA, create a Withdrawals transaction with the National PTA Membership Payable account.

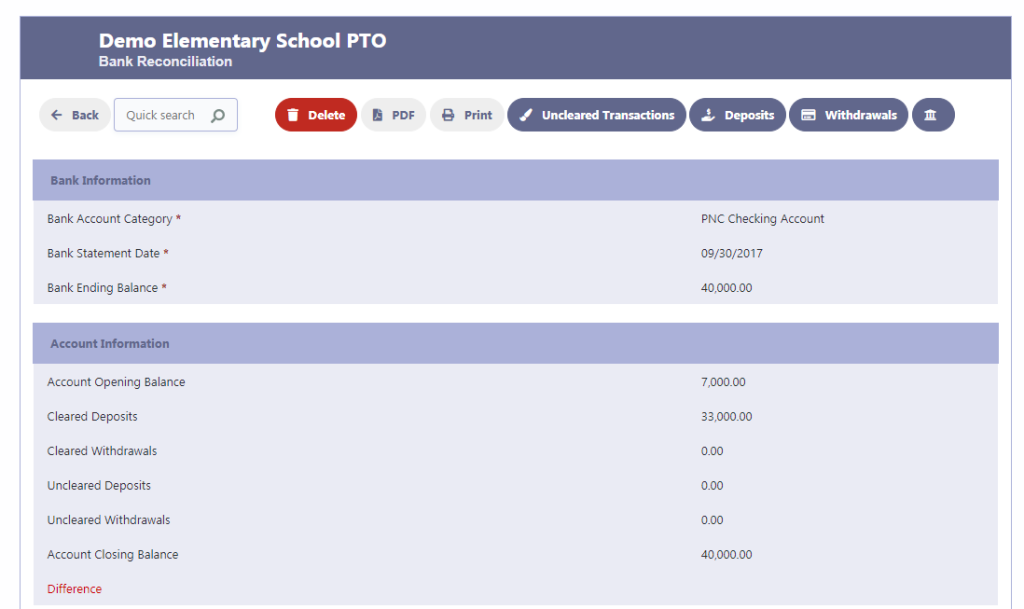

Bank Reconcilation

- Find the actual bank balance at the end of the month.

- Do monthly Bank Reconcilation with the bank balance to check if your books amounts matches.

- Check if there are any uncleared transactions if the amounts do not match.

- Check missing transactions in Deposits and Withdrawals

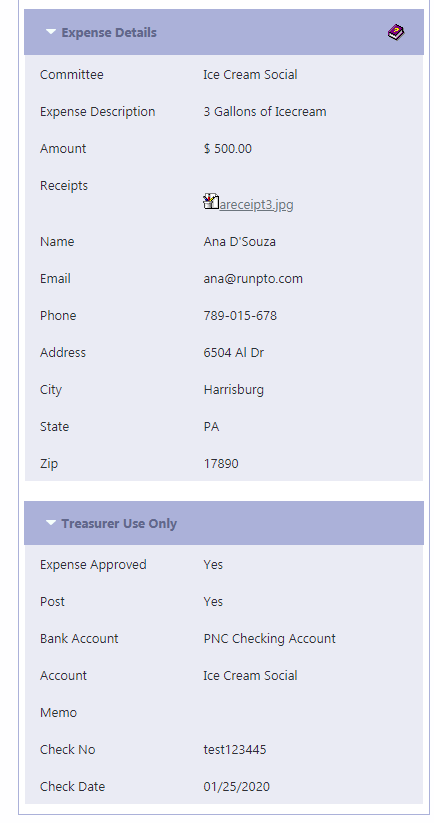

Get expenses submitted online with the Expense Form.

- A Committee/Program chairperson creates and submits an expense form online with attached receipts

- Treasurer receives a notification that an expense report is ready for approval.

- The Treasurer reviews the expense report and verifies that electronic receipts are attached to the expense report.

- Treasurer approves the expense report.

- The Treasurer posts the Expense to the appropriate account

- After the expense report is posted, payment is authorized for the expense report, and the Chairperson/Volunteer is reimbursed.

Review the Various Financial Statements

Real Time reports can be displayed/ printed in one click with graphs and summaries on the screen or downloaded as a PDF document, Word Document or Excel document for easy and on the spot presentation on Mobile, Tablet or Desktop.

- Bank Register

- Transaction Reports By Account Groups, By Committees, By Contacts, By 990EZ classifications.

- Income Statement

- Balance Sheet

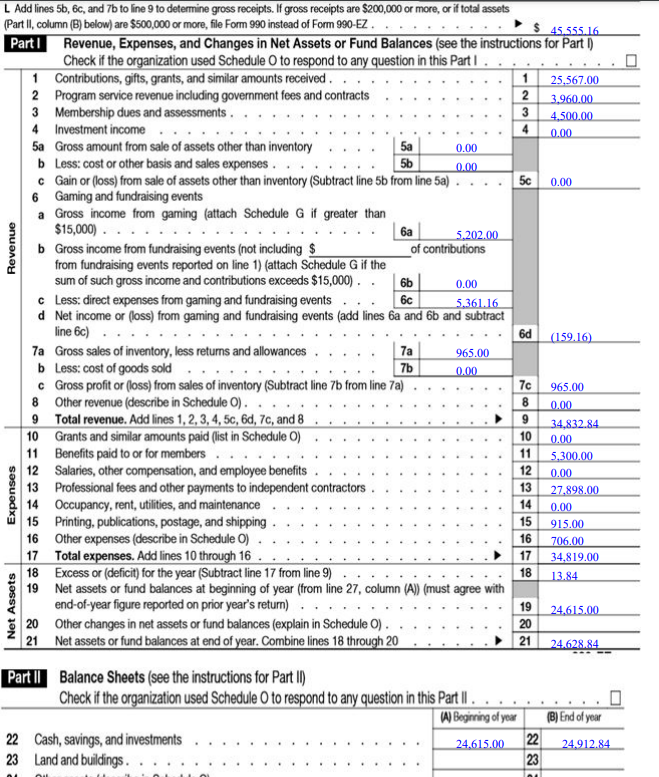

990EZ Tax Form

- Assign 990EZ codes to accounts in Chart of Accounts

- Prepare for your IRS tax filing with the automated 990EZ Report and generated 990EZ Tax form